home loan eligibility malaysia

Repayment period of up to 35 years or age of 70. 2 Including loans other than from banks.

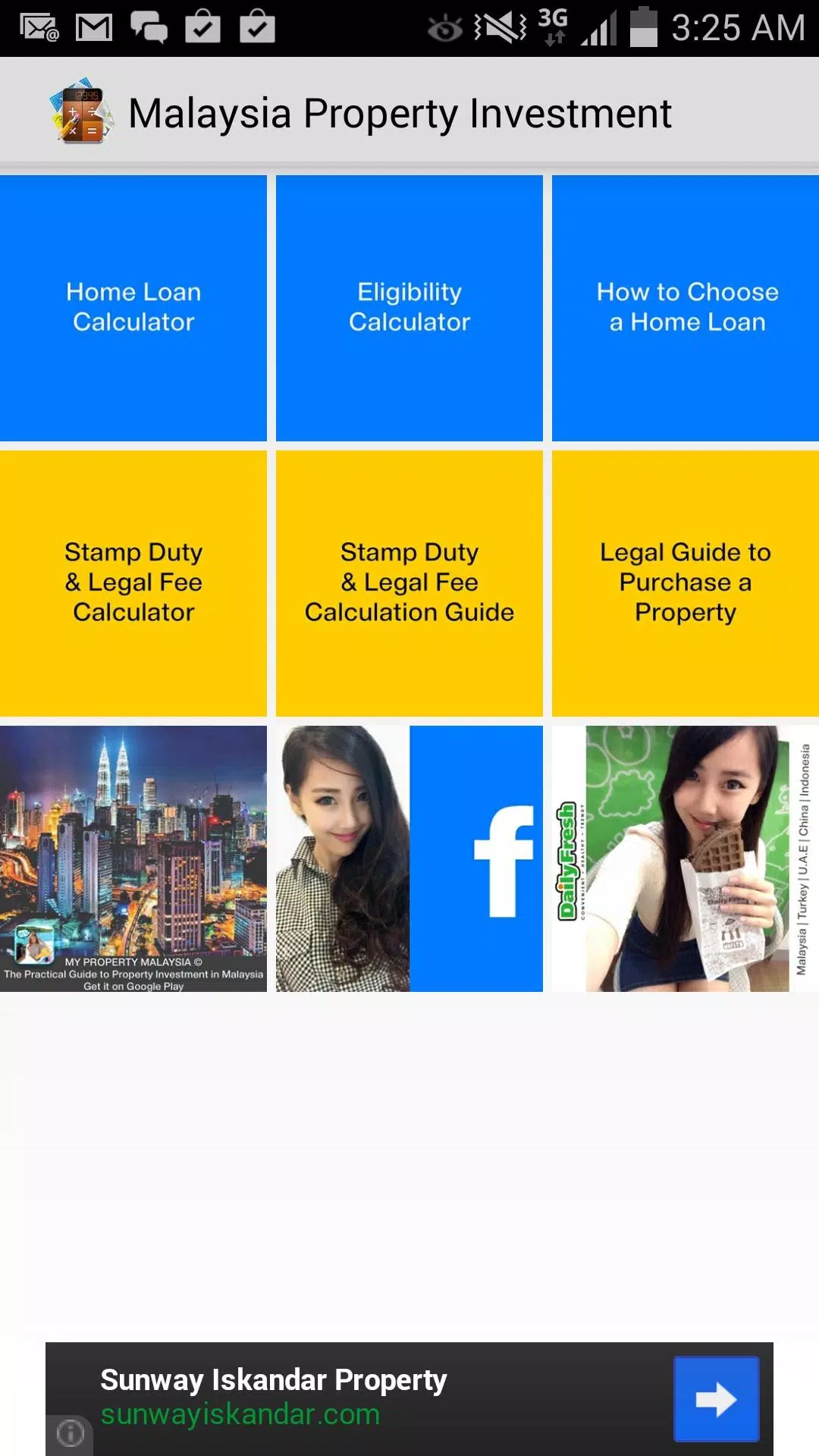

Home Loan Eligibility Affordability Calculator

Higher loan eligibility.

. The current BR for CIMB is set at 275 pa which means its home loan interest or profit rates will be slightly higher than this amount due to the addition of the. Flexible to choose term loanoverdraft or both. Home Loan Eligibility Check Home Loan Eligibility Quick Check Quickly find out the loan amount that you can afford to borrow from banks in Malaysia based on simple financial profiling.

EdgeProps Loan Check makes it easier for you to know your chances on home loan approval. As a general guideline in Malaysia. Generally the loan tenure is dependent on your age the younger you are the longer your loan tenure.

4 The loan eligibility is only an. Home Loan Eligibility Calculator This calculator estimates the maximum housing loan amount based on your annual income and ability to service the loan. In addition the total debt must not exceed 80 percent of net.

Refinance Home Loan Eligibility THE MAXIMUM REFINANCING LOAN SHE CAN GETS The houses current Market Value is RM550000. Heres how it works. Use our FREE tool to calculate and compare home loan eligibility with up to 17 banks find the.

Contact Us At 6012-6946746. In Malaysia the maximum loan tenure is 35 years or until the borrower turns 70 years. Loan-to-value LTV ratio The LTV ratio is a risk assessment tool used to determine how much the bank is willing to finance on.

4 Factors That Affect Housing Loan Eligibility 1. What is Home Loan Eligibility. Just provide your employment details salary current earnings and commitments and the report will provide your DSR loan.

Calculate and compare your home loan eligibility in Malaysia. 1 Minimum monthly payment. And the home loan outstanding balance.

Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a particular. For the first home loan the monthly instalment must not exceed 60 percent of the basic salary and fixed allowance. And the home loan outstanding.

3 The maximum loan tenure is 35 years or up to 70 years of age whichever earlier. The moving cost included legal fees stamp duty disbursement fees and. Youve got questions Weve got answers.

A flexible home loan with different packages. Zero Moving Cost Home Loan Malaysia 2022 is a home loan package where the bank absorbs all the moving costs. Refinance Home Loan Eligibility THE MAXIMUM REFINANCING LOAN SHE CAN GETS The houses current Market Value is RM550000.

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

My Home Loan Calculator Apk For Android Download

Refinance Home Loan Eligibility 2022 Malaysia Housing Loan

5 Things Banks Look For When Applying For A Home Loan

How To Use A House Loan Calculator In Malaysia

Everything You Need To Know About Home Loans In Malaysia

Alliance Flexlink Home Loan Alliance Bank Malaysia

Everything You Need To Know About Home Loans In Malaysia

How Much Can You Borrow Based On Your Dsr

First Time Home Buyer Housing Loan Personal Banking Always With You Malaysia

Malaysia My Second Home Cimb Home Loan Cimb

Property Affordabillity Calculator Home Loan Calculator Cimb

Part 2 Housing Loan Checklist 4 Documents You Need To Prepare If You Re A Self Employed Person Iproperty Com My

Pdf A Review On Housing Affordability In Malaysia Are We Doing Fine

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Flexi Housing Loan Personal Banking Always With You Malaysia

Budgeting 101 What To Prepare For Before Purchasing A Property

Comments

Post a Comment